Big changes are coming to Companies House. Whether you’re a company director, property investor, or small business owner, the upcoming updates will affect how you register, file, and manage your business information in the UK.

At NiS Accountants, we’re keeping our clients ahead of the curve. Here’s a practical breakdown of the key changes and what action you should take.

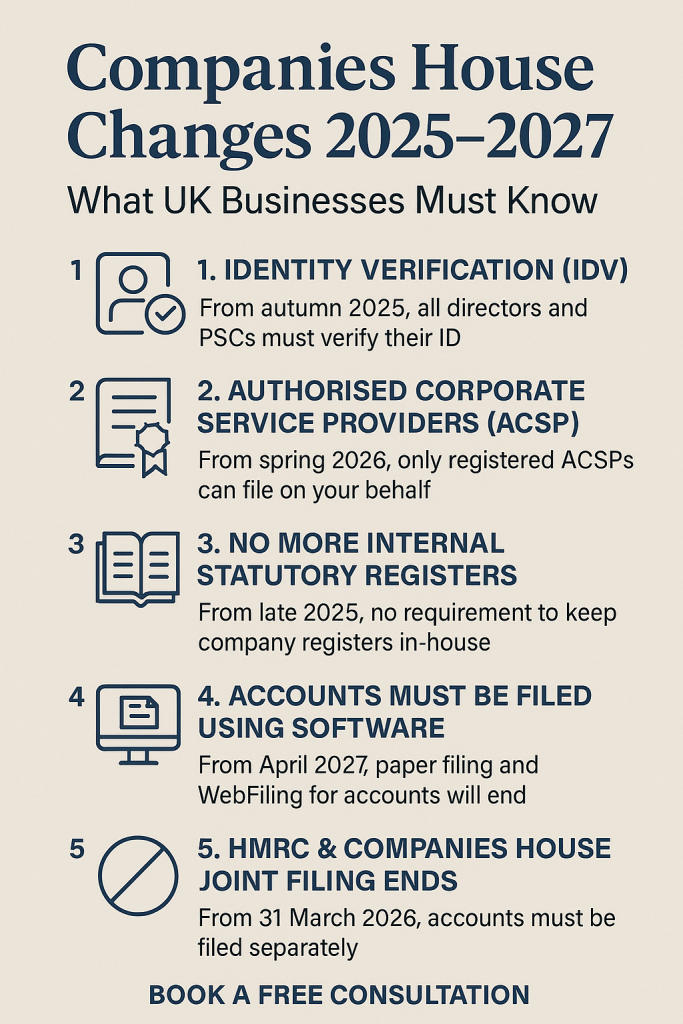

Quick Overview of What’s Changing

| Change | Starts From | Key Impact |

|---|---|---|

| Identity verification | Autumn 2025 | Mandatory for directors & PSCs |

| Agent registration as ACSP | Spring 2026 | Only registered firms can file on your behalf |

| Statutory registers held centrally | Autumn 2025 | No need to keep in-house records |

| Software-only accounts filing | April 2027 | Paper and WebFiling routes phased out |

| Joint filing with HMRC ends | March 2026 | Separate submissions needed |

1. Identity Verification (IDV)

From Autumn 2025, all directors and Persons with Significant Control (PSCs) must verify their identity.

- This applies to new company incorporations and existing companies via their next confirmation statement.

- Identity verification will be done via GOV.UK One Login or an Authorised Corporate Service Provider (ACSP).

➡️Why it matters: Without verification, company filings will be rejected and penalties may apply.

2. Authorised Corporate Service Providers (ACSPs)If you rely on an accountant, solicitor or agent to file on your behalf, they must become a registered ACSP by Spring 2026.

- Only ACSPs will be allowed to file certain information for clients.

- NiS Accountants will ensure uninterrupted support for our clients.

3. No More Internal Statutory Registers

From late 2025, Companies House will maintain statutory registers (e.g. directors, PSCs, shareholders) centrally. You’ll no longer be required to keep these records in-house.

➡️What this means: Greater transparency for the public, less admin for businesses.

4. Accounts Must Be Filed Using Software

From April 2027, Companies House will only accept accounts filed through approved software. Paper submissions and the WebFiling portal will be retired.

- This applies to all companies, including micro-entities and small companies.

- Abridged accounts will no longer be allowed.

➡️What to do now: If you’re still filing manually or via WebFiling, it’s time to switch to cloud-based systems.

5. HMRC & Companies House Joint Filing Ends From 31 March 2026, you must file accounts separately with HMRC and Companies House. The joint submission route will be closed permanently.

How NiS Accountants Can Help

We’re here to make compliance easy and stress-free:

- Assisting with ID verification

- Preparing your business for software-only filing

- Supporting clients as a registered ACSP

- Offering tailored advice for landlords, developers, and SMEs

Book a free consultation to check your company’s readiness:

Contact NiS Accountants | in**@***************co.uk | 07429 116 684

Final Thought

These changes are designed to increase corporate transparency and improve the integrity of the UK business environment. With early preparation and the right support, your business can stay compliant and protected.