Published: Feb 2025

By NiS Accountants

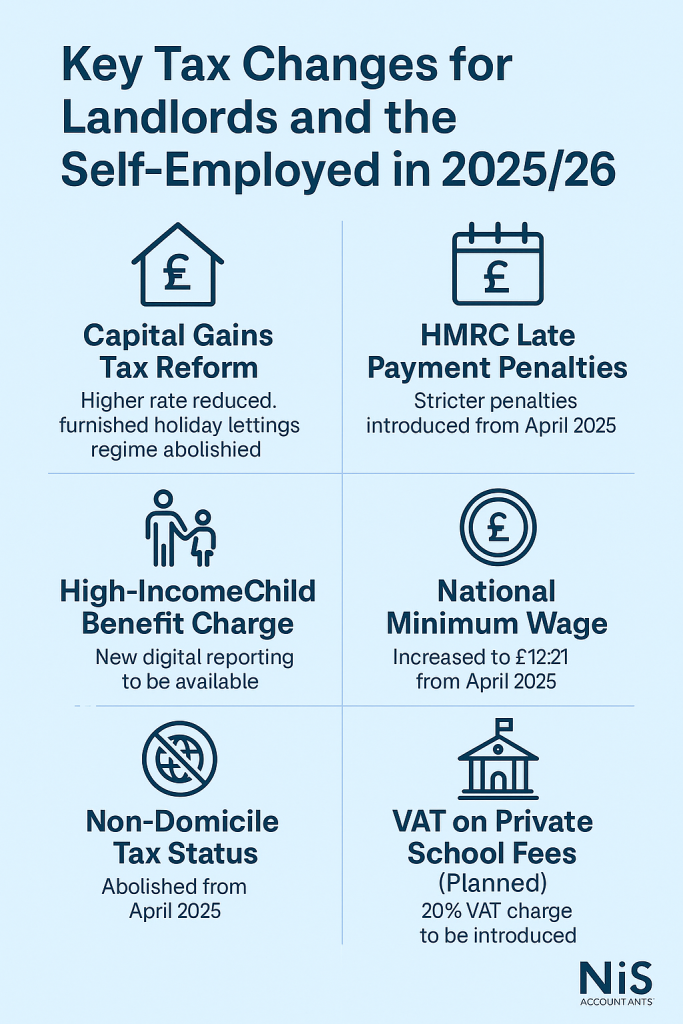

As the 2025/26 tax year unfolds, several important tax changes will affect landlords, self-employed individuals, and small business owners. Staying ahead of these updates is essential for remaining compliant and making informed financial decisions.

1. Capital Gains Tax (CGT) Reform for Property Sales

From 6 April 2024, the higher rate of Capital Gains Tax on residential property gains was reduced from 28% to 24%, offering welcome relief for higher-rate taxpayers. The basic rate remains at 18%.

In addition, the Furnished Holiday Letting (FHL) tax regime will be abolished from April 2025, aligning tax treatment with standard buy-to-let properties. This change will remove tax reliefs specific to FHLs, including certain capital allowances and CGT reliefs.

2. Stricter Late Payment Penalties from HMRC

From April 2025, HMRC will implement a new points-based penalty system for late payments. The revised system introduces:

- 2% penalty if tax remains unpaid after 15 days

- An additional 2% if unpaid after 30 days

- A further 4% per annum interest penalty from day 31 onwards

This underscores the importance of prompt tax payments and maintaining sufficient cash flow.

3. High-Income Child Benefit Charge (HICBC) Simplified

Starting in 2025, those subject to the HICBC will be able to manage and pay the charge via a new PAYE portal, removing the need to complete a full Self Assessment return if no other income reporting is required.

This is expected to ease the administrative burden for many higher-earning households.

4. National Minimum Wage Increase

From April 2025, the National Living Wage (now applicable to all workers aged 21 and over) has increased to £12.21 per hour. This impacts payroll budgets for small business owners and should be factored into financial planning.

5. Abolition of Non-Domiciled Tax Status

The Government has confirmed that from April 2025, the traditional non-domicile tax regime will be abolished. It will be replaced by a residency-based tax system, affecting those who previously used the remittance basis of taxation.

If you or your clients have non-dom status, now is the time to review your tax residency and income remittance strategy.

6. VAT on Private School Fees (Planned)

A 20% VAT charge on private school fees is expected to be introduced from January 2025, as part of the current Government’s broader education tax reform agenda. While legislation is still pending final approval, affected families should begin planning for the financial impact now.

How NiS Accountants Can Support You

Whether you’re a landlord, self-employed individual, or business owner, these changes may affect your tax liabilities and financial planning.

At NiS Accountants, we offer:

- Clear, jargon-free advice on how these changes affect you

- Strategic tax planning to minimise liabilities

- Support with payroll, CGT, and Self Assessment compliance

- Guidance for families impacted by HICBC or private school VAT

Contact NiS Accountants today to arrange a free consultation and stay ahead of the curve this tax year.